Magento 2 Creditsafe Integration

Boost your Magento 2 store's financial intelligence with the "Magento 2 Creditsafe Integration" module. Seamlessly integrate Creditsafe APIs for robust identity verification, credit reports, and rule-based decision-making. Ensure secure data logging, rule creation, and easy rule management for evaluating and assigning credit limits. Elevate your customer registration process with advanced billing address validation and empower your store with a toolset for informed financial decisions.

- Creditsafe API Integration: Access robust credit reports seamlessly from Creditsafe.

- Adds option for customers to apply for Credit application, upon success assign credit limits which can be used by them to make purchases.

- Adds option to capture billing address upon registration which can be used to fast pace the credit application process.

- Seamless Company Credit Report Retrieval: Gain insights into company creditworthiness seamlessly.

- Consumer/Individual Credit Report Retrieval: Retrieve Credit Reports for Consumers/Individuals based on that assign the appropriate credit limit.

- Seamless Company Credit Report Retrieval: Gain insights into company creditworthiness seamlessly.

- Consumer/Individual Credit Report Integration: Expand your understanding of individual credit profiles.

- Advanced Rules Engine for Decision-Making: Craft customized rules based on the retrieved credit reports to automatically manage credit limit assignment upon credit application.

- Dynamic Rule Creation and Management: Flexibility to adjust rules as per your business needs.

- Logging Settings Configuration: Keep track of all Creditsafe API requests and responses.

- Display Credit Limit: Display Credit Limits for customers in their My account section and on the Checkout Page.It is also displayed under each customer for admins.

- Configuration for Minimum Credit Limit: Set minimum limits to meet your store's requirements.

- Customizable Messages and Emails: Personalize messages and emails for minimum credit limits, success or failed applications to communicate effectively with customers. Also sends the failure emails to admin to swiftly action and improve customer satisfaction.

- Pay by Invoice: Allow customers to place orders using their credit limit with our "Pay by Invoice" payment method. This feature is available only when the basket value is less than the customer's credit limit.

- Adjustment Grid: An adjustment grid is added to the dashboard, allowing you to track and manage adjustments made to customer credit limits based on their orders and payments. Besides automatic adjustments manual adjustments are also possible by an adjustment import feature.

Free Support

up to 60 days

Free Upgrades

up to 1 year

Fully open source

Product description

The "Magento 2 Creditsafe Integration" Module

Compatible with Magento 2 community and enterprise 2.3.3 - 2.4.x including cloud edition

The "Magento 2 Creditsafe Integration" module by Scommerce Mage brings a new dimension to your Magento 2 store's functionality, enhancing financial intelligence and decision-making capabilities. Our "Magento 2 Creditsafe Integration" module is your gateway to seamlessly integrating Creditsafe APIs, unlocking a world of possibilities for credit reports retrieval, identity verification, and intelligent decision-making.

About Creditsafe:

Creditsafe, a global business intelligence provider, offers comprehensive credit reports, identity verification, and company data. With a database spanning millions of companies worldwide, Creditsafe empowers businesses to make informed decisions, minimize credit risk, and strengthen financial strategies.

Creditsafe API Integration

Gone are the days of manual credit report retrieval. With our integration, you gain direct access to Creditsafe's robust credit reports, ensuring every transaction is backed by reliable data and insights. The module is capable of retrieving credit reports for both consumers/individuals as well as companies based on which you can assign the appropriate credit limit.

Streamlined Credit Application Process

Empower your customers with the convenience of applying for credit directly through your Magento 2 store. Upon successful application, our module automatically assigns credit limits, enabling seamless transactions and fostering customer loyalty. The rules by which these credot limits get assigned are completely configurable. The following features contribute to making this process smooth:-

- Capture Billing Address on Registration: The module adds option to capture the billing address on registeration or signup page which can be later used for credit application making the process smooth and fast. This option is also configurable. Elevate your customer registration process with advanced billing address validation. Ensure accurate and complete billing details to streamline the registration process and enhance data integrity.

- Display Credit Limit in My Account Section and Checkout:- The customers with credit limits will be able to see this data in their My Account section as well as on checkout page highlighting the credit available to them which can be used to make the purchases.

- Dedicated Credit Application Section:- The module adds dedicated "apply for credit application" option in the My account section using which customers can apply for credit application either as a consumer or a company.

- Payment:- You can now manage customer credit limits with ease. Our system allows customers to place orders using their credit limit with our "Pay by Invoice" payment method. This feature is available only when the basket value is less than the customer's credit limit. This ensures that customers can only spend up to their available credit limit, reducing the risk of bad debt and improving cash flow management.

- Credit Management:- Adds an Credit Adjustment Grid allowing you to track and manage adjustments made to customer credit limits based on their orders and payments. With our system, you can view and manage adjustments made to customer credit limits in a single, easy-to-use grid. This feature is particularly useful for tracking adjustments made to customer credit limits, ensuring that your business operations run smoothly and efficiently. Our system automatically records adjustments when orders are placed or refunded using the "Pay by Invoice" payment method. This ensures that your business operations run smoothly and efficiently, with adjustments recorded automatically. This feature is particularly useful for businesses that receive a high volume of orders and payments. Manual adjustments are possible in the grid through the import adjustments feature enabling you to import adjustments in CSV format to update the adjustment grid.

Company Search Form Integration:

Effortlessly integrate the Creditsafe Company Search API into your store's company search form. Enhance the user experience by providing a dropdown menu with matching company names based on entered details.

Advanced Rules Engine for Decision-Making

Craft customized rules based on real-time credit reports to automate credit limit assignments. Whether it's adjusting limits based on credit scores or evaluating payment history, our module empowers you to make informed decisions effortlessly.

-

Dynamic Rule Creation and Management

Flexibility is key in the ever-evolving landscape of credit management. Our module offers dynamic rule creation and management, allowing you to adapt to changing business needs and optimize credit management strategies.

Seemless Identity Verification

Our module offers an optional verification process that provides added security and assurance for credit limit applications. Administrators have the flexibility to toggle this feature on or off based on their store's requirements, ensuring adaptability to varying business needs. When enabled, customers can apply for a credit limit using Creditsafe, either as an individual or a company, streamlining the application process. Upon submission, customers receive configurable success or failure messages, providing clarity and transparency throughout the process.

For successful applications, customers are prompted to provide supporting documents to verify their identity and address, such as a passport, driving license, or utility bill. The success message conveniently includes a list of required documents and the designated email address for submission. Customers can then send the documents directly to the administrator via email, initiating the verification process.

Administrators meticulously review the submitted documents and assess the customer's credit limit accordingly. Upon completion, the customer table is updated with a "verified customer" attribute, denoting the verification status as true or false. Customers are promptly notified of the verification result and their updated credit limit status, ensuring timely communication and transparency.

To facilitate a fair process, customers have the opportunity to retry applying for a credit limit up to a maximum number of times, as determined by the administrator. Once a customer's account has been verified, they are unable to change their billing address, further enhancing security and stability in credit management. With these additional features, Magento 2 Creditsafe Integration empowers administrators to manage credit limits with confidence and efficiency, while providing customers with a seamless and secure experience.

Credit Limit Assignment:

Assign credit limits dynamically based on customizable rules defined in the rules engine. Configure minimum credit limits and choose to display credit limits on the My Account page, offering transparency to customers.

Logging Settings Configuration

Transparency and security are paramount when dealing with sensitive financial data. With our module, you can easily configure logging settings to track all Creditsafe API requests and responses, ensuring compliance and peace of mind.

Personalized Communication

Effective communication is key to building trust and fostering customer relationships. Customize messages and emails for various scenarios, from successful credit applications to minimum credit limit notifications. Plus, receive automatic notifications for failed applications, allowing you to promptly address any issues and enhance customer satisfaction.

Advantages of Having Credit Functionality on your Magento 2 Store

Offering credit functionality in ecommerce stores can provide several benefits, both for the business and its customers. Here are some key advantages:

Increased Sales and Customer Loyalty:

Providing credit options allows customers to make purchases even when they may not have the funds upfront. This can lead to increased sales and foster customer loyalty as individuals are more likely to return to a store that offers flexible payment solutions.

Improved Customer Acquisition:

Credit offerings can attract new customers who may be enticed by the ability to buy now and pay later. This can be especially appealing to individuals who prefer the convenience of credit for online shopping.

Competitive Advantage:

Offering credit sets a store apart from competitors and provides a unique selling proposition. Customers often choose retailers that provide flexible payment options over those that don't, giving businesses a competitive edge in the market.

Higher Average Order Value (AOV):

Credit options can lead to higher AOV as customers may be inclined to purchase more when they have the flexibility to spread payments over time. This can contribute to increased revenue for the ecommerce store.

Enhanced Cash Flow Management:

While customers enjoy the convenience of credit, businesses benefit from improved cash flow management. The immediate influx of funds from credit sales allows for better financial planning and the ability to invest in growth initiatives.

Reduced Cart Abandonment:

Credit options can help reduce cart abandonment rates. Customers who hesitate due to budget constraints may proceed with their purchase when presented with credit alternatives, leading to completed transactions.

Catering to Different Customer Segments:

Not all customers have the same financial circumstances. Offering credit accommodates a diverse range of customers, including those who prefer spreading payments, those with irregular income, or those facing temporary financial constraints.

Flexible Payment Terms:

Ecommerce stores can tailor credit offerings to suit different needs, such as interest-free periods, installment plans, or revolving credit lines. This flexibility allows businesses to cater to a variety of customer preferences.

Encourages Repeat Business:

Customers who have positive experiences using credit options are likely to return for future purchases. This repeat business contributes to customer lifetime value and strengthens the long-term relationship between the customer and the ecommerce store.

Strategic Partnerships with Financing Providers:

Establishing partnerships with financing providers or credit institutions allows ecommerce stores to offer credit options without assuming the entire financial risk. This can be a collaborative approach to expanding credit offerings.

Adaptation to Market Trends:

As the retail landscape evolves, the ability to adapt to market trends becomes crucial. Offering credit aligns with the growing trend of flexible and convenient payment solutions, ensuring that the ecommerce store stays relevant in a competitive market.

Trust and Credibility:

Providing credit options enhances the trust and credibility of the ecommerce store. Customers perceive businesses offering credit as financially stable and customer-centric, fostering a positive brand image.

The main highlights of the module are-:

- Creditsafe API Integration for Identity Verification and Credit Reports: Seamlessly integrate Creditsafe APIs for comprehensive identity verification and access to credit reports.

- Enable customers to apply for credit directly, with automatic credit limit assignment upon approval.

- Capture billing addresses during registration to expedite the credit application process

- Gain insights into company and individual creditworthiness with comprehensive credit report retrieval

- Craft customized rules based on credit reports for automated credit limit management

- Enjoy flexibility with dynamic rule creation and management

- Configure logging settings for transparent tracking of Creditsafe API requests and responses

- Display credit limits prominently in customer accounts and during checkout

- Allow customers to place orders using their credit limit with our "Pay by Invoice" payment method. This feature is available only when the basket value is less than the customer's credit limit.

- Whenever an order is placed or refunded using the "Pay by Invoice" payment method, our system will automatically record the appropriate adjustments in the adjustment Grid/table.

- Easily import adjustments in CSV format to update the adjustment grid with payments made by customers manually.

- Personalize messages and emails for effective communication with customers and receive automatic admin notifications for failed credit applications

- Seamless Company Credit Report Retrieval: Retrieve company credit reports seamlessly by utilizing the integrated Creditsafe Company Credit Report API.

- Consumer/Individual Credit Report : Integrate consumer/individual credit reports to fetch detailed credit information.

- Configuration for Minimum Credit Limit: Set a minimum credit limit to tailor credit offerings according to business requirements.

- Easily facilitate identity verification for customers ensuring security and transparency.

We offer 60 days of free support and 12 months of free upgrade for any standard Magento site when you buy this extension. You can also get our installation service for a small fee. If you want more benefits, you can purchase our 12 months of free premium support and free lifetime upgrade package. Please contact us if you need any assistance or customization for this extension. We will reply to you within 48 hours. We may also offer you a special deal or a free solution if we like your idea.

** Please refer to our FAQ or T&C section for running our extensions on multiple domains or sub-domains

FAQ

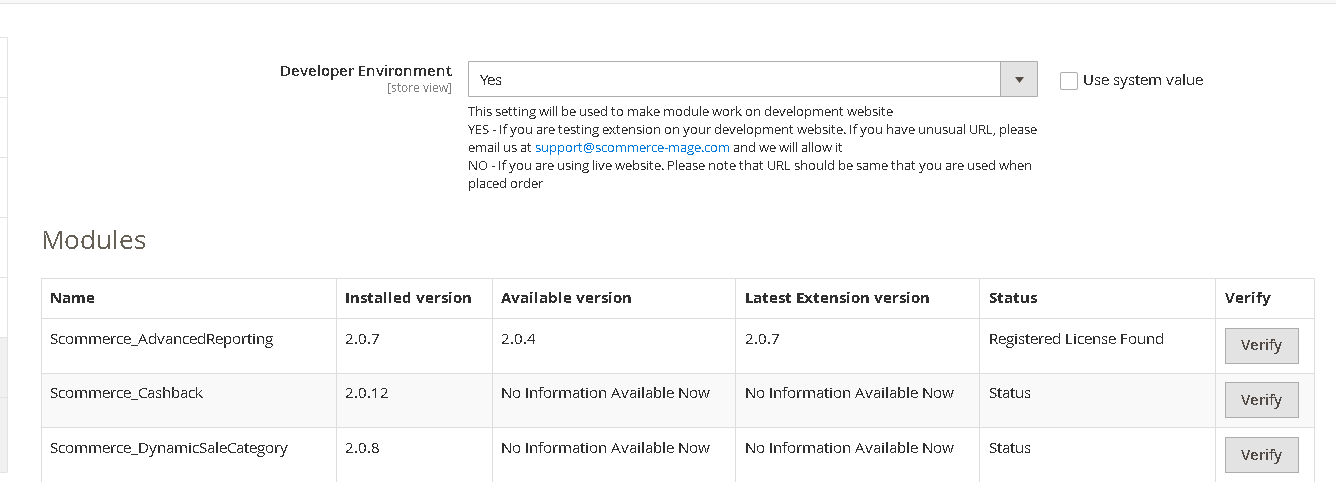

Once added go to Stores>Configuration>Scommerce Configuration> Core and set "Development Environment" to "Yes" then click on verify. Once verified the license will start working on your staging site.

https://www.scommerce-mage.com/magento-extension-installation-service.html

Once you received the latest version of our extension then we would highly recommend to delete all the files and folder of our extension from your website first before uploading the latest version because we might have removed existing files and keeping existing files could cause problems on your website.

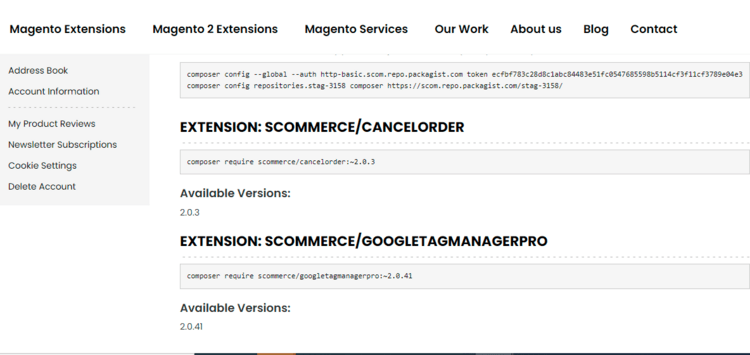

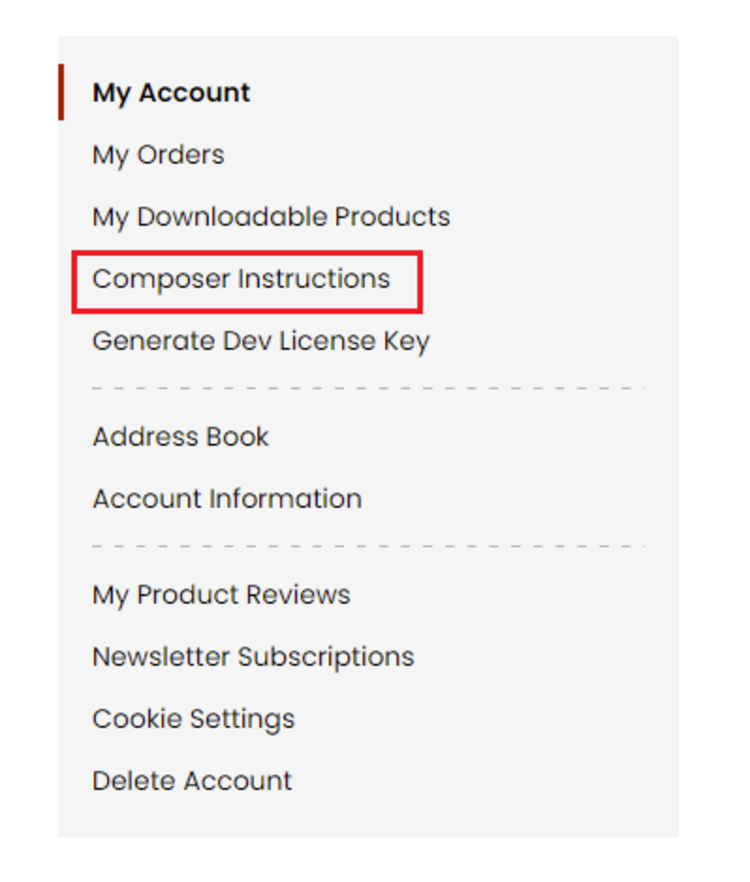

Step 2: Next, run the config commands shown on the top of the page then click on the extension that you want to install. A composer require command will be revealed in the dropdown menu. Run the command then clear caches to complete the installation.

Step 2: Next, run the config commands shown on the top of the page then click on the extension that you want to install. A composer require command will be revealed in the dropdown menu. Run the command then clear caches to complete the installation.